When it comes to managing your health, medications often play a crucial role. However, the cost of prescriptions can be a significant burden.

With expenses going up, finding ways to save money is more important than ever. Let’s explore practical tips that make healthcare smarter and more affordable, especially when dealing with prescription medications.

What You Should Know About the Price?

First, let’s get a clear picture of why it can be so expensive. Factors include development costs, patents, and market exclusivity, which allow drug companies to set higher prices.

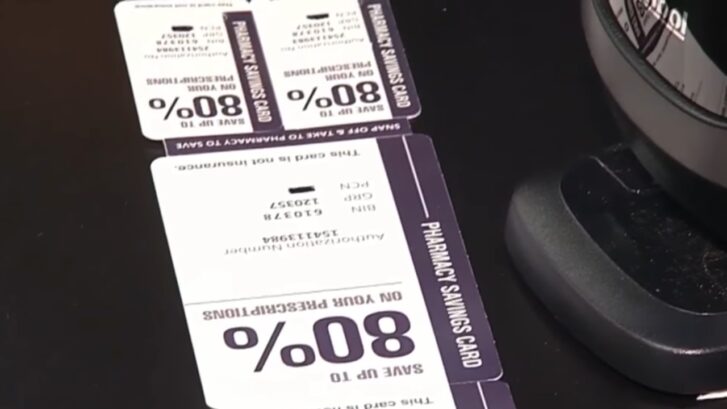

Additionally, the lack of generic alternatives for certain medications can keep prices high. For those exploring options to lower their costs, BuzzRx offers a practical solution with its free prescription discount card that can be used at over 60,000 pharmacies nationwide, potentially saving up to 80% on medication costs.

7 Tips for Reducing Prescription Costs

1. Ask About Generic Alternatives

One of the most straightforward ways to save is to inquire about generic alternatives to brand-name medications. Generics contain the same active ingredients and are just as effective but are often significantly cheaper.

Don’t hesitate to ask your doctor or pharmacist if a generic version is available and suitable for your treatment.

2. Compare Pharmacy Prices

Prices for the same medication can vary widely from one pharmacy to another. Use online tools and apps to compare prices at local pharmacies. Sometimes, the difference in cost can be substantial, making it worth the trip to a different store.

3. Use Prescription Discount Cards

Several organizations and companies offer prescription discount cards that can provide savings on many medications.

These cards are often free and can be used regardless of insurance status. It’s worth checking out options like GoodRx, RxSaver, or even discount programs specific to a pharmacy chain.

4. Consider Mail-Order Pharmacies

For long-term medications, mail-order pharmacies can offer convenience and cost savings. These pharmacies typically provide medications in 90-day supplies at lower prices than traditional pharmacies.

If your insurance plan has a preferred mail-order pharmacy, using it could result in significant savings.

5. Review Your Insurance Plan’s Formulary

An insurance formulary is a list of medications covered by your plan, often organized into tiers with different cost implications. Medications on higher tiers come with higher out-of-pocket costs.

Reviewing the formulary and discussing it with your doctor can help you choose medications that are both effective and more affordable under your insurance plan.

6. Apply for Assistance Programs

Drug manufacturers and nonprofit organizations often offer assistance programs for those who cannot afford their medications.

Eligibility can depend on insurance status and income level. Websites like NeedyMeds.org provide resources and information on various assistance programs.

7. Ask Your Doctor for Samples

If you’re starting a new medication, ask your doctor if they have samples. This can save you the cost of a prescription for a short period and allow you to try the medication before filling a full prescription.

How Can You Check If a Generic Is Available?

To find out if there’s a generic version of a medication you’re prescribed, you can:

- Ask your pharmacist directly.

- Look up the medication on websites like the FDA’s Generic Drug Program.

- Consult with your healthcare provider.

How To Save Money Without Making Compromises?

While saving money on prescriptions is crucial, ensuring you receive the right medication for your health condition is equally important. If you experience mid-section abdominal discomfort, it’s essential to promptly communicate this to your healthcare provider during discussions about any changes to your medication regimen, ensuring the alternatives are safe and effective for your specific situation.

Are Prescription Discount Cards Really Free?

Yes, many prescription discount cards are available for free. They negotiate prices with pharmacies and can offer lower prices on many medications.

However, it’s important to read the fine print and understand that these cards are not insurance but can be used instead of insurance if they offer a better price.

Patient Assistance Programs

For those facing high prescription costs, patient assistance programs (PAPs) present a valuable option. These programs, typically run by pharmaceutical companies, aim to help patients access their medications at a reduced cost or even for free.

Eligibility criteria can vary, often including income limits, insurance status, and residency requirements.

How Do You Apply?

Applying for PAPs usually involves filling out an application and providing proof of income, insurance status, and a prescription from your healthcare provider.

The process can vary from one program to another, so it’s essential to read the application instructions carefully. Many programs offer assistance over the phone or online to help you through the application process.

Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

Health Savings Accounts and Flexible Spending Accounts offer another strategy for managing prescription costs. Both HSAs and FSAs allow you to set aside pre-tax dollars to pay for eligible healthcare expenses, including prescriptions.

The key difference is that HSAs are available to those with high-deductible health plans, while FSAs are more broadly accessible but have a “use it or lose it” policy each year.

How Can HSAs and FSAs Save You Money?

By using pre-tax dollars to pay for your prescriptions, you effectively reduce the net cost of your medications. For example, if you’re in the 22% tax bracket and use $100 from your HSA or FSA for prescriptions, you save $22 in taxes, reducing the actual cost to you.

When Should You Speak to Your Doctor About Prescription Costs?

It’s crucial to discuss prescription costs with your doctor during your appointment, especially if you’re concerned about affordability. Doctors can sometimes switch medications to more cost-effective options or suggest strategies to reduce expenses.

Transparency about cost concerns ensures that your treatment plan is both medically appropriate and financially manageable.

Consider Changing Some Habits

Lifestyle changes can sometimes reduce the need for certain medications, thereby saving on prescription costs.

For example, diet, exercise, and weight loss can significantly impact managing conditions like diabetes, high blood pressure, and high cholesterol. Always consult with your healthcare provider before making any changes to reduce your reliance on medications.

FAQs

Can I Use a Prescription Discount Card with Insurance?

In most cases, you cannot use a prescription discount card in conjunction with insurance.

However, if the discount card price is lower than your insurance copay, you can opt to use the discount card instead of your insurance for that purchase.

Is It Safe to Buy Medications Online?

Purchasing medications online can be safe if you use reputable pharmacies.

Look for pharmacies that are verified by the National Association of Boards of Pharmacy (NABP) or carry the Verified Internet Pharmacy Practice Sites (VIPPS) accreditation.

Can Changing Your Prescription Schedule Save Money?

Sometimes, taking a higher dose of medication less frequently can be more cost-effective. This strategy, known as “pill splitting,” involves splitting a higher-dose pill to achieve your prescribed dose.

Always ask your healthcare provider and pharmacist if pill splitting is safe for your medication and situation.

Final Words

Saving on prescriptions requires a bit of effort and knowledge, but it is entirely possible with the right strategies. From opting for generics to utilizing discount cards and assistance programs, several avenues can lead to significant savings.

Always engage in open conversations with your healthcare providers about cost concerns. They can offer valuable advice and alternatives that suit your health needs and budget. Managing healthcare costs effectively ensures that taking care of your health does not become a financial burden.

Related Posts:

- Dual Diagnosis Treatment Models in California's…

- The Use of QR Codes in Healthcare: How Are They…

- Qualities of a Successful Healthcare Leader: Traits…

- EHR vs. EMR - Differences in Healthcare Record Systems

- How Long Does a Rhinoplasty Take to Heal? 11 Tips…

- What is Anger Management? Tips for Keeping Your Cool